오늘 PU Xtrader 챌린지에 참여하세요

시뮬레이션 자본으로 거래하고 우리의 트레이더 평가를 통과한 후 실제 이익을 얻으십시오.

오늘 PU Xtrader 챌린지에 참여하세요

시뮬레이션 자본으로 거래하고 우리의 트레이더 평가를 통과한 후 실제 이익을 얻으십시오.

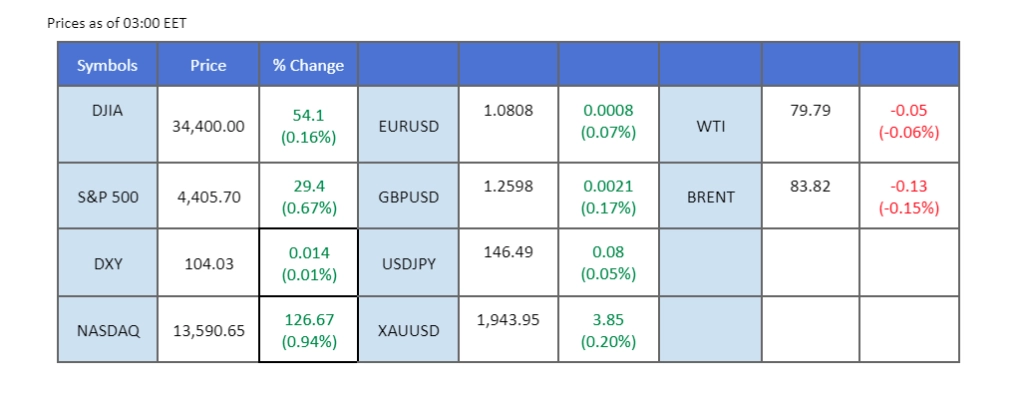

The Fed chief, along with the Deputy Governor of the BoE and the Chair of ECB, have jointly reaffirmed their determination to combat inflation until it remains consistently within the targeted range. This Hawkish stance has contributed to the strengthening of the dollar, which in turn has put pressure on other currencies. Interestingly, the heightened dollar strength hasn’t had a significant impact on commodities such as gold and oil. Both of these assets have managed to find support, resulting in minimal fluctuations in their values last Friday. Shifting focus to China’s economy, it remains in a state of ongoing struggle for recovery. Foreign investors’ confidence in the world’s second-largest economy has waned, leading to the selling off of equity shares worth $11 billion in August. This trend highlights the apprehensions surrounding China’s economic performance.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

Although Jerome Powell has not explicitly outlined the future direction of the interest rate policy for September, the prevailing market sentiment suggests that the Federal Reserve is inclined to continue its rate hikes. This perception is rooted in the Fed’s apparent confidence in the growth trajectory of the U.S. economy and the enduring strength exhibited by the market. An observable consequence of this sentiment is the modest increase in the U.S. 10-year bond yield subsequent to Jerome Powell’s discourse at the Jackson Hole Economic Symposium. This uptick in yield mirrors the market’s anticipation of an upcoming rate hike by the Federal Reserve.

The dollar index is testing the uptrend resistance level and has traded to its highest since early June. The RSI has been hovering near the overbought zone while the MACD continues to flow above the zero line, suggesting the bullish momentum is intact with the dollar.

Resistance level: 104.40, 105.30

Support level: 103.85, 103.30

Even as the dollar gains strength due to Jerome Powell’s hawkish stance at the Jackson Hole Economic Symposium, gold prices have managed to hold their ground firmly. Notably, policymakers from the ECB and the BoE have aligned with the Federal Reserve in their endeavour to counter inflation. This shared commitment comes against the backdrop of economies that are comparatively less robust. The appeal for safe-haven assets has experienced an uptick as investors adopt a more cautious approach in response to the prolonged period of elevated interest rates. This cautious sentiment is driving a heightened demand for safe-haven assets.

Gold prices have rebounded and traded sideways between $1910 to $1920, awaiting for a solid catalyst. The RSI failed to break above the overbought zone while the MACD has crossed above the zero line, suggesting the bullish momentum for gold has diminished.

Resistance level: 1938.00, 1967.00

Support level: 1900.00, 1865.00

The Euro experienced a slight decline last Friday, even though the market’s perception leaned towards an increased likelihood of the Federal Reserve continuing its rate hikes in September, following a hawkish statement from the Fed’s chair at the Jackson Hole Economic Symposium. The Chair of the European Central Bank (ECB) also restated the necessity for interest rates in the Eurozone to be maintained within a restrictive range in order to control inflation-supported euro. The ECB’s commitment to sustaining higher rates for an extended period if required was evident. Meanwhile, investors eagerly await the release of Eurozone Consumer Price Index (CPI) data scheduled for Wednesday, as it will provide insights into the strength of the euro’s position.

The EUR/USD continues to trade below its long-term downtrend resistance level. The RSI and the MACD both moved in the lower territory, suggesting a bearish signal for the pair.

Resistance level: 1.0848, 1.0925

Support level: 1.0760, 1.0700

The Sterling faced a setback, unable to maintain its foothold above the support level of 1.264 against the robust U.S. dollar. The Deputy Governor of the Bank of England (BoE) delivered a relatively hawkish statement at the Jackson Hole Economic Symposium; however, this pronouncement hasn’t acted as a catalyst to drive Sterling’s value higher. Compounding this, recent economic data hasn’t aligned with the conditions necessary for the UK’s central bank to adopt an aggressive stance in raising interest rates. Indications are pointing towards the UK potentially entering an economic downturn, which is influencing the BoE’s caution in its policy approach.

The Sterling has broken below its price consolidation range while both RSI and MACD are moving downward, suggesting a bearish signal for the Cable.

Resistance level: 1.2640, 1.2780

Support level: 1.2540, 1.2460

The USD/JPY pair has experienced a notable surge, surpassing its recent resistance level of 146.50. This movement can be attributed to differing statements from the heads of the BoJ and the Federal Reserve during the Jackson Hole Economic Symposium. The BoJ’s governor has maintained a persistently dovish stance, contrasting with the Fed’s position. The Japanese central bank remains committed to maintaining its low-interest rates, contingent upon substantial evidence indicating that inflation in Japan is on a sustainable trajectory. In this evolving landscape, investors are grappling with uncertainty about the potential timing of intervention by Japanese authorities to uphold the currency’s value, particularly as it edges closer to the 147.00 mark against the USD.

USD/JPY is trading higher with the RSI approaching the overbought zone while the MACD crossed above the zero line, suggesting the bullish momentum remains.

Resistance level: 147.20, 148.25

Support level: 145.60, 145.00

Although Jerome Powell reiterated concerns about persistently high inflation in the U.S. and emphasised the Federal Reserve’s readiness to implement further rate hikes, he also expressed confidence in the American economy during his statements. Powell highlighted the tight labour market conditions and the signs of recovery in the housing market, both of which reflect the overall strength of the U.S. economy. Interestingly, despite the Fed’s unwavering stance on combating inflation, the market appears to find encouragement in Powell’s confidence. This sentiment is likely bolstered by his positive assessment of the economic landscape. However, given the dynamics at play, the equity market is anticipated to experience heightened volatility as August draws close.

Dow Jones is trading flat and is currently suppressed under its short-term resistance level near 34500. The RSI remains below the 50-level while the MACD is flowing below the zero line, suggesting the momentum for the index is weak.

Resistance level: 34800.00, 35400.00

Support level: 34200.00, 3360.00

Overseas investors have divested themselves of approximately $11 billion worth of shares, indicating a notable decline in confidence in China’s economy, which is still grappling with challenges in returning to its pre-pandemic level of growth. The Chinese equity market remains under pressure, with foreign investors continuing their selling spree for 13 sessions. In a bid to stimulate the market, Chinese authorities have reduced the stamp duty on stock trading by half, a measure that became effective at the beginning of this week. This move has had an immediate impact, leading to an upward surge of more than 500 points in the index, signalling a positive market response to the stimulus initiative.

The index has rebounded more than 700 points from its recent low and has broken above its near-resistance level. The MACD has crossed while the RSI has rebounded from the oversold territory, signalling for a trend reversal.

Resistance level: 19130, 19860

Support level: 17570, 16890

Oil prices managed to recover slightly from their recent monthly low, which was around the $78 level. This resurgence in oil prices can be attributed to the positive outlook prevailing in the market following Jerome Powell’s mention of strong consumer spending and the revival of housing expenditures during the Jackson Hole Economic Symposium. These factors have lent support to the pricing of oil. Conversely, a noteworthy development in the oil industry pertains to the actions of oil drillers in various U.S. shale regions. These drillers are curtailing their operations, a move that is poised to result in a reduction of oil supplies. This decline in supply is expected to contribute to an upward trajectory in oil prices.

Oil prices are steadily supported at near the $80 mark. The RSI has rebounded and is approaching the overbought zone, while the MACD has crossed below the zero line, suggesting a trend reversal for oil prices.

Resistance level: 82.30, 83.20

Support level: 79.15, 76.80

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

새로운 등록 불가능

현재 새로운 등록을 받고 있지 않습니다.

새로운 가입은 사용할 수 없지만, 기존 사용자는 평소와 같이 도전과 거래 활동을 계속할 수 있습니다.