오늘 PU Xtrader 챌린지에 참여하세요

시뮬레이션 자본으로 거래하고 우리의 트레이더 평가를 통과한 후 실제 이익을 얻으십시오.

오늘 PU Xtrader 챌린지에 참여하세요

시뮬레이션 자본으로 거래하고 우리의 트레이더 평가를 통과한 후 실제 이익을 얻으십시오.

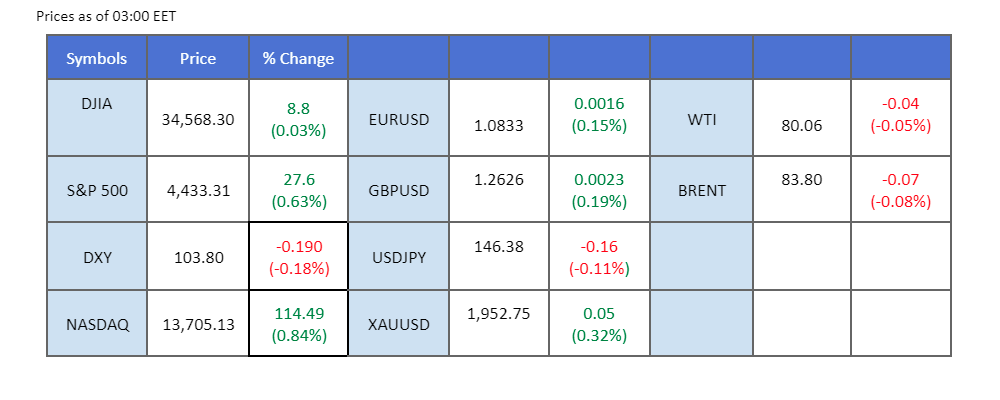

US equities advanced as the dollar’s vigor abated after assimilating Jerome Powell’s Jackson Hole Symposium discourse. Powell’s subtly dovish tone vowed meticulous inflation management to foster risk appetite. Speculation also swirled around a softer labor market and subdued wage growth. Conversely, Japan witnessed its unemployment rate ascend for the first time in four months, weakening the yen. Additionally, anticipation looms over China’s forthcoming PMI data, slated for Thursday, seen as a litmus for the oil price trajectory.

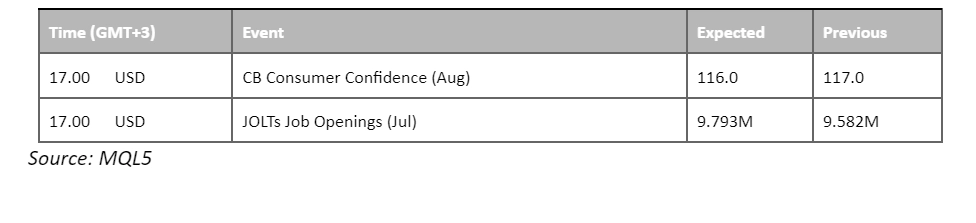

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The dollar index displayed a gentle retreat, slipping beneath the $104 threshold in anticipation of impending job data. The prevailing sentiment among market participants suggests that the labour market might experience a further softening, coupled with a moderation in wage growth, thus contributing to a potential dampening of inflationary pressures. Consequently, there is a growing expectation within the market for the Fed to adopt a more accommodative monetary stance. This sentiment is underscored by the anticipation of a restrained rate hike in September, with the size of the increase expected to be minimal.

The uptrend resistance level suppresses the dollar index and tests the 1st support level. The RSI has failed to break into the overbought territory while the MACD has crossed on the above, suggesting the bullish momentum is easing.

Resistance level: 104.40, 105.30

Support level: 103.85, 103.30

The more subdued performance of the dollar has acted as a bolstering factor for the upward movement of gold prices, with attempts being made to breach its price consolidation range. Notably, the lack of a notably hawkish statement from the Federal Reserve’s chair during the Jackson Hole Economic Symposium has contributed to alleviating dollar strength. Presently, the dollar index is situated below the $104 threshold. Furthermore, amidst the lingering uncertainty regarding China’s economic challenges, gold prices could find support due to the prevailing conditions of uncertainty.

Gold prices are attempting to break above their price consolidation range, a break above such a range could serve as a bullish signal for gold prices. The RSI hovers in the upper region while the MACD flows flat, suggesting the bullish momentum is still intact.

Resistance level: 1938.00, 1967.00

Support level: 1900.00, 1865.00

The euro experienced a rebound as the dollar lost strength yesterday. Market participants embraced a higher risk appetite following insights from Jerome Powell’s dialogue at the Jackson Hole Economic Symposium. Amid a more accommodative stance from the Federal Reserve, market sentiment is leaning toward the possibility of a more relaxed labour market, contributing to a weaker dollar. Additionally, investor focus remains on the upcoming Eurozone CPI data set to be unveiled on Thursday, offering insights into the Euro’s strength.

The EUR/USD had a technical rebound in the last session and is approaching its long-term uptrend resistance level. The MACD is flowing flat while the RSI still hovers at the lower territory, providing a weak trend reversal signal for the pair.

Resistance level: 1.0848, 1.0925

Support level: 1.0760, 1.0700

The Australian dollar has shown signs of recovery after a prolonged period of price consolidation since mid-August. The currency’s upturn could be attributed to the Chinese government’s endeavours to stimulate economic growth, bolstering market confidence, particularly in the equity sector. Recent measures, such as halving the stamp duty on equity trading, have spurred positive movement in the market since the start of the week. Moreover, market participants eagerly anticipate Australia’s housing data set to be disclosed on Wednesday, which could offer insights into the Australian dollar’s resilience.

The pair is approaching it near resistance level, a break above the 0.6440 level can serve as a bullish signal. The RSI has been gaining and the MACD moving closely along the zero line suggests a short-term bullish momentum is forming.

Resistance level: 0.6500, 0.6580

Support level: 0.6390, 0.6320

The USD/JPY pair exhibited quiet movement in the recent session due to the expected dovish Fed policy and imminent job data. Economists now predict the Japanese yen could weaken to levels unseen since 1990, revising their forecast from 135 to 155 against the USD. This shift is attributed to the Bank of Japan’s unique expansionary policy stance, coupled with the widening interest rate gap between the US and Japan, reinforcing expectations for a continued weak yen against the strong dollar.

USD/JPY is trading flat at near the 146.40 level and is expecting to form a technical retracement. The RSI has eased from its rebound while the MACD is flowing flat, suggetting the bullish momentum is diminishing.

Resistance level: 147.20, 148.25

Support level: 145.60, 145.00

The current market sentiment is optimistic, driven by the anticipation that the Federal Reserve may implement a comparatively dovish monetary policy in September. This sentiment is particularly evident ahead of the impending job data release. Notably, the Dow Jones Industrial Average exhibited a substantial gap up, surging by over 200 points. This market movement can be attributed to the prevailing belief that the labour market is poised for further cooling, accompanied by a projected moderation in wage growth. These factors collectively contribute to the tempering of inflation risks, thus instilling confidence in the market’s trajectory.

Dow Jones gapped up and broke above its short-term resistance level, signalling a bullish trend. The RSI is approaching the overbought zone while the MACD has crossed above the zero line, suggesting the bullish momentum is forming.

Resistance level: 34800.00, 35400.00

Support level: 34200.00, 3360.00

The Hang Seng Index has posted gains for two consecutive sessions, driven by a recent move by Chinese authorities to halve the stamp duty on equity trading. This strategic decision aims to invigorate the equity market and counter its lacklustre performance. China’s equity market has faced challenges stemming from a sluggish economic recovery, resulting in significant foreign fund outflows. Investors are now eyeing the forthcoming release of the Chinese manufacturing PMI on Thursday, a key indicator that will shed light on the country’s economic strength.

The index has rebounded more than 700 points from its recent low and has broken above its near-resistance level. The MACD has crossed while the RSI has rebounded from the oversold territory, signalling for a trend reversal.

Resistance level: 19130, 19860

Support level: 17570, 16890

Oil prices experienced a modest upturn, driven by a sense of encouragement stemming from the prospect of a more accommodative stance by the Federal Reserve. The prevailing market sentiment revolves around the anticipation that the forthcoming job data will signal a cooling labour market in the United States, accompanied by a moderation in wage growth. This, in turn, is expected to contribute to a dampening effect on inflation. Should the Federal Reserve adopt a dovish approach in response, it is believed that this could catalyse increased economic activities, consequently exerting a favourable influence on oil demand.

Oil prices traded back to $80 mark and showed signs of trend reversal. The RSI has rebounded rapidly while the MACD has crossed above the zero line, suggesting the bullish momentum is forming.

Resistance level: 83.25, 87.25

Support level: 79.15, 76.80

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

새로운 등록 불가능

현재 새로운 등록을 받고 있지 않습니다.

새로운 가입은 사용할 수 없지만, 기존 사용자는 평소와 같이 도전과 거래 활동을 계속할 수 있습니다.