오늘 PU Xtrader 챌린지에 참여하세요

시뮬레이션 자본으로 거래하고 우리의 트레이더 평가를 통과한 후 실제 이익을 얻으십시오.

오늘 PU Xtrader 챌린지에 참여하세요

시뮬레이션 자본으로 거래하고 우리의 트레이더 평가를 통과한 후 실제 이익을 얻으십시오.

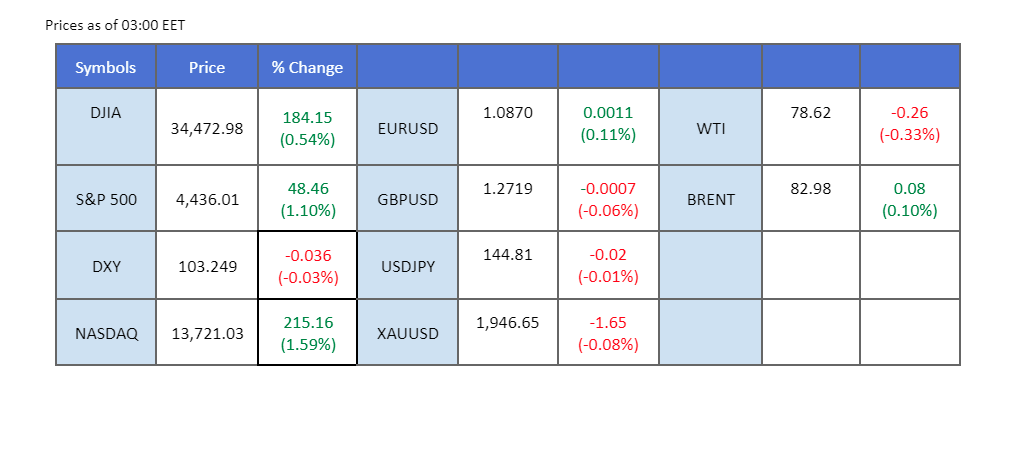

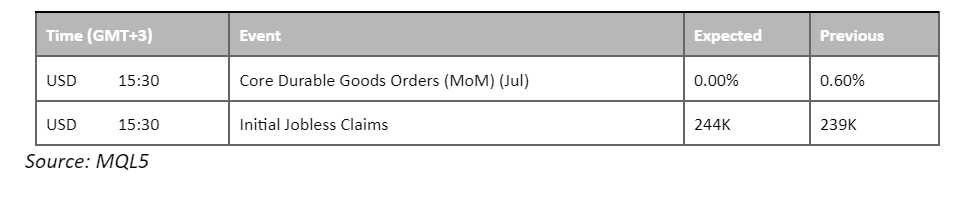

A downward spiral hit the euro region currencies, including the euro and Pound Sterling, as economic data revealed a softer-than-expected state of affairs. Both the Eurozone and UK’s PMI numbers fell below the 50 mark, signaling an economic contraction. Consequently, the euro and sterling tumbled with the lacklustre economic data, raising concerns of potential rate pauses. In contrasting events, the U.S. equity market experienced a surge, driven by Nvidia Corp’s remarkable performance. The tech giant, one of the world’s largest companies, reported an outstanding 171% increase in earnings, surpassing expectations. Meanwhile, all eyes are on the Jackson Hole Economic Symposium, which commences today. This event holds significant importance as it offers insights into the interest rate outlook for some of the globe’s most influential economies.

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US Dollar retreats against key currencies due to subdued economic data, depicting US business activity hovering near stagnation. In August, the service sector experienced a contraction in new business demand, resulting in the weakest growth since February. The S&P Global US Composite PMI Index, encompassing both manufacturing and services, fell from July’s 52 to 50.4, marking the most significant decline since November 2022.

The dollar index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 103.85, 104.30

Support level: 103.30, 102.55

US Treasury yields decline from recent peaks as investors reassess their views on imminent rate hike decisions. With anticipation building for Federal Reserve Chair Jerome Powell’s appearance at the Jackson Hole symposium, gold benefits from the drop in US Treasury yields and the concurrent moderation in the Dollar.

Gold prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the commodity might enter overbought territory.

Resistance level: 1930.00, 1950.00

Support level: 1900.00, 1880.00

The euro faced a significant decline following releasing the Eurozone’s PMI data, revealing a more substantial contraction in the regional economy than anticipated. The Eurozone’s composite PMI and Services PMI witnessed larger declines than expected, with the Services PMI dipping below the critical 50 threshold for the first time since February. However, there was a subsequent recovery in the euro-dollar pair as the dollar eased in response to disappointing PMI figures. This shift prompted a rebound for the euro. All attention is now focused on the upcoming Jackson Hole Economic Symposium. This event carries heightened importance as it features the participation of both the Fed’s and ECB’s chairs. Market participants eagerly await any insights these central bank leaders might offer regarding the future direction of interest rates.

The EUR/USD is supported above its short-term support level at 1.0850. The RSI and MACD flow flat, given a neutral signal for the pair.

Resistance level: 1.0924, 1.0990

Support level: 1.0848, 1.0760

Disappointing UK’s economic data sparked concerns about a potential halt in rate hikes, causing a sharp decline in the value of the Sterling yesterday. The Manufacturing and Services PMI in the UK experienced larger drops than initially anticipated, with readings falling below the critical 50 mark, signifying an economic contraction. However, Sterling regained some ground following a decline in the U.S. PMI that also failed to meet expectations, leading to a weakening of the dollar. In addition to these dynamics, investors are looking forward to insights from the BoE Deputy Governor’s speech at the Jackson Hole Economic Symposium. This event holds the potential to shed light on the outlook for interest rates in the UK, further influencing market sentiment.

The Sterling traded close to its downtrend resistance level and has fallen back to the price consolidation range. The RSI flows below the 50 level, and the MACD flows flat, suggesting the momentum is weak.

Resistance level: 1.2780, 1.2870

Support level: 1.2640, 1.2550

Ahead of the Federal Reserve’s Jackson Hole symposium, global central banks, particularly the Bank of Japan, remain watchful regarding the Fed’s forthcoming statement. Concerns in Japan revolve around the potential impact of hawkish signals from US counterparts that might lead to severe yen depreciation and necessitate currency intervention. Sources indicate that Japan’s currency policy architects are closely monitoring the situation, according to Reuters.

USD/JPY is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the pair might enter oversold territory.

Resistance level: 145.00, 145.60

Support level: 144.05, 143.40

The US equity market gains traction as US Treasury yields recede, aligning with the upcoming Jackson Hole Symposium. Notably, the tech sector gains momentum on the back of Nvidia’s exceptional quarterly performance. Nvidia’s impressive $13.5 billion revenue surpasses expectations by over $2 billion, driven by robust demand for AI-driven computer chips.

Dow Jones is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the index might enter oversold territory.

Resistance level: 35605.00, 36520.00

Support level: 34260.00, 33720.00

The Australian dollar experienced a noteworthy rebound and has surpassed its long-term downtrend resistance level. This resurgence comes after a period of price consolidation ranging from 0.644 to 0.639. The catalyst behind this rebound primarily stems from lacklustre economic data from the U.S., as the PMI reading turned out worse than anticipated last night. This weaker data contributed to a decrease in the strength of the dollar. Adding to this positive momentum was a speech by the President of China during the BRICS summit. This address reinforced confidence in China’s economy, subsequently benefiting the Australian dollar as a proxy currency linked to Chinese economic performance.

AUD/USD rebounded after consolidating for the past few sessions and is traded above the downtrend resistance level. The RSI is approaching the overbought zone while the MACD broke above the zero line, suggesting a bullish bias for the pair.

Resistance level: 0.6500, 0.6580

Support level: 0.6440, 0.6380

Oil prices dip due to the interplay between rising US gasoline stocks and uninspiring manufacturing data worldwide. Despite optimism stemming from a sizable decrease in US crude stocks, concerns arise about burgeoning gasoline inventories. Concurrently, global manufacturing data, particularly Japan’s persistent factory activity decline, Europe’s business activity contraction, and Britain’s recession risk, underscore economic vulnerabilities.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 79.00, 83.25

Support level: 76.90, 74.25

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

새로운 등록 불가능

현재 새로운 등록을 받고 있지 않습니다.

새로운 가입은 사용할 수 없지만, 기존 사용자는 평소와 같이 도전과 거래 활동을 계속할 수 있습니다.