오늘 PU Xtrader 챌린지에 참여하세요

시뮬레이션 자본으로 거래하고 우리의 트레이더 평가를 통과한 후 실제 이익을 얻으십시오.

오늘 PU Xtrader 챌린지에 참여하세요

시뮬레이션 자본으로 거래하고 우리의 트레이더 평가를 통과한 후 실제 이익을 얻으십시오.

15 June 2023,05:45

Daily Market Analysis

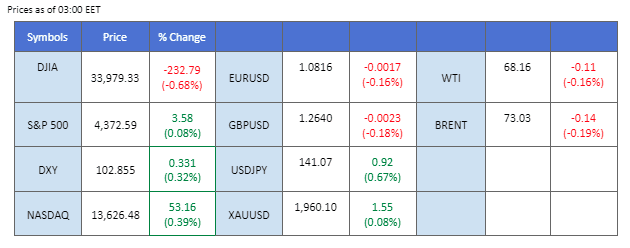

The Federal Reserve kept the interest rate unchanged at 5.25%, in line with market expectations, as U.S. inflation showed signs of moderating. Despite a rate pause, the dollar quickly erased its losses as Jerome Powell, the Fed’s chair, said most Fed officials agreed to raise the rate further. On the other hand, Australia’s bond yield recorded its first inverted yield curve since 2008. A sign of an increased risk of recession in the country may put the RBA in the dilemma of raising interest rates as the country is also facing inflationary pressure. Elsewhere, oil prices were hammered by surprise rises in U.S. oil inventories; the stockpiles rose to 7.9 million barrels, leading the oil prices to plunge by nearly 1% last night.

Current rate hike bets on 16th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (30%) VS 25 bps (70%)

The US Dollar initially experienced a dip in response to the Federal Reserve’s decision to pause its interest rate hike. This pause signalled a potential shift in the central bank’s monetary policy stance. However, the greenback swiftly rebounded as the market reacted to the Fed’s hawkish statement regarding future monetary policy. The statement, delivered by Fed Chair Jerome Powell during the press conference, indicated that the borrowing costs would likely increase by another 50 basis points (bps) by the end of December, contingent upon sustained strong performance of the US economy.

The dollar index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the index might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 103.30, 103.90

Support level: 102.70, 102.00

Gold prices dropped initially in response to Federal Reserve Chair Jerome Powell’s statement, which indicated that most Fed officials expect further interest rate hikes in 2023 to address inflation. The expectation of higher interest rates made alternative investments, such as bonds or savings accounts, more attractive to investors seeking higher yields. As a result, investors initially diverted their funds away from gold, a non-yielding asset, towards interest-bearing assets. This shift in investor sentiment caused a drop in gold prices as demand for the precious metal decreased in anticipation of tightening monetary policy.

The overall movement in the gold market appears weak, suggesting the potential for further slow bearish momentum in the near future. Recent price action indicates a lack of strong bullish momentum and a possible shift towards a bearish sentiment. Investors may be inclined to seek higher-yielding alternatives, which could further weigh on gold prices.

Resistance level: 1980.00, 2005.00

Support level: 1940.00, 1915.00

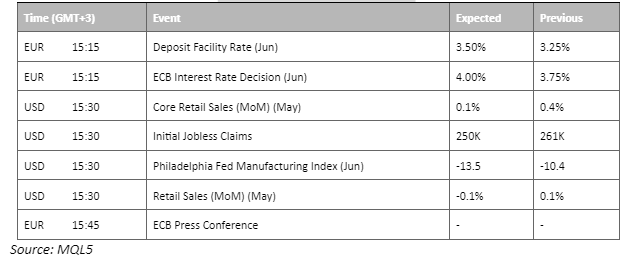

Although the Fed interest rate decision aligned with the market expectation, which kept the interest rate at 5.25%, it had little impact on the dollar, and the euro stayed flat against the USD. Notwithstanding the rate pause, Jerome Powell commented that most Fed officials agree to raise the rate further and expects the rate to go as high as 5.6% at the end of the year. The relatively hawkish statement from the Fed fuels the dollar’s strength although the interest rate stands pat this round. The ECB will announce its interest rate decision later today while the market widely believed that the ECB will raise another 25 bps this round.

EUR/USD had a mild retracement last night but it is still trading within the uptrend channel. The RSI constantly stays on the upper range while the MACD is still climbing, depicting the pair’s bullish momentum is still intact.

Resistance level: 1.0841, 1.0891

Support level: 1.0811, 1.0777

The USD/JPY pair experienced a notable surge following the release of the Federal Reserve’s hawkish statement, where they pledged to further raise interest rates by an additional 50 basis points in their efforts to tackle the soaring inflation. This development triggered a renewed widening of the US-Japan treasury yields, as astute investors foresee the Bank of Japan’s commitment to uphold its quantitative easing program. Consequently, it is imperative for investors to closely monitor the monetary decisions emanating from the Bank of Japan, as these will provide crucial trading signals that could significantly impact the ongoing dynamics of the market.

USD/JPY is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 65, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 142.05, 146.20

Support level: 138.50, 133.85

The pound experienced a slight upward movement against the dollar on Wednesday, propelled by the release of data indicating modest growth in the British economy throughout April. According to the Office for National Statistics, there was a 0.2% month-on-month expansion, primarily fueled by the thriving retail and film sectors. While these figures depict a gradual growth trajectory rather than a recessionary decline, traders remained wary due to conflicting data revealing persistent inflationary pressures. Despite the GDP reading showing progress in comparison to the previous year’s energy crisis, concerns were heightened by Tuesday’s wage data, which raised red flags about the ongoing intensity of inflation. With these mixed signals influencing market sentiment, investors are advised to exercise caution and await further economic data to gain a clearer perspective on the overall trend.

Both the MACD and RSI indicators are signalling a bullish momentum in the market, indicating a potential upward trend in price. The convergence of these technical indicators suggests a favourable environment for buyers and may attract increased investor interest.

Resistance level: 1.2647, 1.2691

Support level: 1.2573, 1.2500

The Dow Jones Industrial Average experienced a slight downturn after the Federal Reserve revealed their projection for additional rate hikes. The central bank now anticipates its terminal rate, or peak rate, to reach 5.6% by the midpoint of 2023, representing an upward revision from the previous forecast of 5.1% recorded in March. This adjustment suggests that two more interest rate hikes remain within the realm of possibility. In line with this hawkish stance, US Treasury yields closed the day at their highest levels, reflecting the market’s assimilation of the Fed’s outlook. Consequently, this hawkish sentiment exerted further downward pressure on the US equity market, contributing to the Dow’s marginal decline.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 59, suggesting the index might extend its losses toward support level.

Resistance level: 34210.00, 35475.00

Support level: 32715.00, 31660.00

On Wednesday, oil prices dropped 1.5% to $68.74 per barrel due to the U.S. Federal Reserve’s projection of additional interest rate hikes this year. Although the Federal Reserve did not immediately raise interest rates, its indication of a potential half-percentage point increase by year-end reflected a response to an unexpectedly robust economy and a slower decline in inflation. This projection prompted market concerns, as investors feared that a higher interest rate environment would likely dampen oil demand.

As of the latest analysis, the MACD and RSI indicators signal a neutral-bearish momentum. The current neutral-bearish momentum implies caution among investors, as the market could be vulnerable to a decline or consolidation in the near term.

Resistance level: 70.70, 74.20

Support level: 67.20, 65.00

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

새로운 등록 불가능

현재 새로운 등록을 받고 있지 않습니다.

새로운 가입은 사용할 수 없지만, 기존 사용자는 평소와 같이 도전과 거래 활동을 계속할 수 있습니다.